Preparation of the Merangin Regency Regional Macroeconomic Framework Document

The preparation of RKPD documents requires regional economic data and analysis, which are used to assess the impact of previous development on economic performance and to determine the achievement of economic indicators in accordance with those assumed in other planning documents. The regional economic analysis referred to above can be obtained through regional macroeconomic analysis and regional fiscal analysis. Macroeconomic and fiscal analysis is important in the preparation of regional development planning. This information forms the basis for formulating policies that are relevant, effective, and responsive to the needs of the community. With strong analysis, the government can map economic potential and challenges and determine development priorities that are in line with national and local development targets.

The objectives of the Macroeconomic Analysis and Fiscal Analysis of Merangin Regency are: 1) To understand and analyze the regional economic conditions in 2023, including macroeconomics (GRDP, economic growth rate, inflation, investment with ICOR/Incremental Capital Output Ratio, unemployment, poverty, and inequality); 2) To analyze estimated economic conditions for 2025-2029, including macroeconomics (GRDP, LPE, ICOR, unemployment, poverty, and inequality); 3) To determine projected macroeconomic indicators for 2025-2029, taking into account regional projections; 4) Analyzing the effectiveness of regional fiscal policy in 2023 through the Tax Revenue Ratio, PAD Effectiveness Ratio, Regional Financial Efficiency Ratio, Capital Expenditure Ratio, Growth Ratio, and Regional Financial Independence Ratio; 5) To determine the projected effectiveness of regional fiscal policy for 2025-2029 through the Tax Revenue Ratio, Local Revenue Effectiveness Ratio, Regional Financial Efficiency Ratio, Capital Expenditure Ratio, Growth Ratio, and Regional Financial Independence Ratio.

Macroeconomic analysis provides an overview of Merangin Regency’s position compared to surrounding regions, while fiscal analysis assesses the regency’s ability to meet public service needs and drive economic growth. Thus, both analyses are crucial in development planning to ensure that development implementation can improve community welfare in line with the targets set.

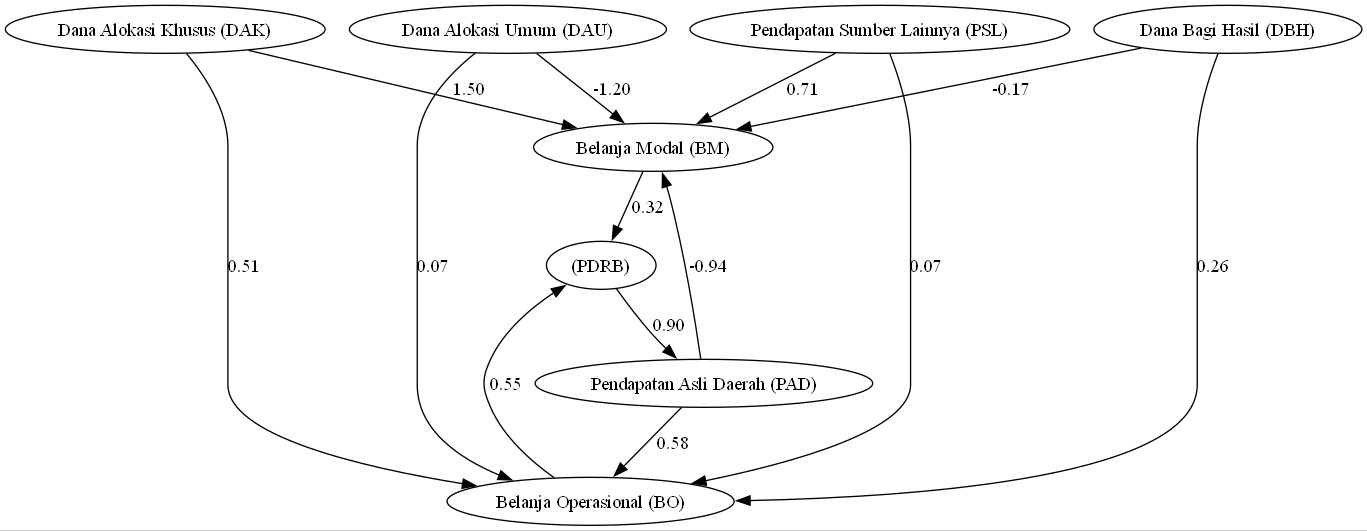

Based on the analysis results, the SEM model of the relationship between the APBD and PDRB reflects how various funding sources affect regional expenditure (capital and operational spending) and how this expenditure impacts economic growth (PDRB) and fiscal capacity (PAD). Capital expenditure contributes directly to PDRB growth, while operational expenditure is more dependent on PAD. GRDP is the main indicator that influences the region’s ability to generate PAD, which is then used to finance operations. The SEM model provides information that efficiency in the use of transfer funds and capital expenditure can maximize regional economic growth (GRDP) and increase fiscal capacity through PAD. An increase in PAD can be encouraged through the creation of added value, particularly in the agricultural sector (in a broad sense).

In addition, the results of the SEM model analysis of the relationship between APBD, PDRB, and poverty show that PDRB has a significant effect on poverty levels. An increase in GRDP tends to contribute to a decrease in poverty, indicating that regional economic growth plays an important role in improving community welfare. Optimizing the use of General Allocation Funds (DAU) for long-term investment, not just for operational expenditure, will have a greater impact on economic growth and poverty reduction.

Similarly, the results of the ICOR analysis for the 2018-2023 period found that the average ICOR was 5.04, which is quite high, indicating that the efficiency of investment in generating economic output can still be improved. Investment needs to be continued through sectoral ICOR analysis, with considerations including prioritizing investment in business fields with a small ICOR coefficient, business fields that absorb a large workforce, business fields that have high backward and forward linkages, and business fields that have considerable market potential.

Indonesia

Indonesia